THE STORY

When I was a child in school, I preferred multiple choice tests over true or false tests. With multiple choice tests, I found it relatively easy to guess when I did not know the answer. In nearly all cases, the correct answer would be the option that had the most words in it. So when I didn’t know the right answer, I’d pick the wordiest option.

True or False answers were

harder to guess. You either wrote a “T”

for true or an “F” for false. One was

not wordier than the other. For awhile,

I tried to perfect the writing of an answer that looked half-way between a T or

an F. It sort of looked like it could be

either a T or an F. My hope was that

the teacher would be biased towards correct answers when grading and that my

half-way letter would be interpreted as the correct answer due to that

bias. But that method was not as

reliable as the multiple choice guessing method.

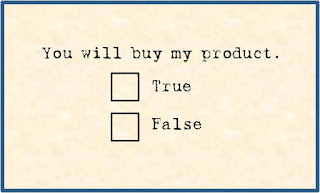

In the business world, it often seems as if executives look at sales as being like a true or false test. The question goes something like this: “Did you get the sale? (T or F).” And from the point of view of the executive answering the question, this seems logical.

The problem with this approach

is that it does not provide any insight into the selling process. It doesn’t help us answer a variety of essay

questions, like:

- Why did we get (or not get) the sale?

- What would cause us to get more sales?

- What is causing us to lose sales?

- What approach should I use to get the next sale?

- How can we make our sales more profitable?

Worse yet, I think the true or

false approach wrongly distorts the way we look at the selling process. Yes, from the company’s perspective, getting

the sale is a true or false event.

However, from the point of view of the potential customer, the event is

much more like a multiple choice question.

The consumer has lots of choices

for how to spend their time and their money.

To them, the choice is rarely binary—it is not “Do I buy your product?

(yes or no).” Instead, the question to

them is “Which of my many options is the best choice for how I spend my time

and money?”

The alternatives to the consumer

are many. It can be between very similar

products such as “Brand X” soup versus “Brand Y” soup. It can be a choice between related products,

like eating soup at home versus going out to eat at a restaurant. It can also be between vastly different

products. An extreme example could be a

young woman’s choice between going back to college or having a baby.

Choices between extremely

different options happen all the time. For

example, a teenager may want to be popular at school. To get there, the teen may consider a number

of different options, like spending their money on the latest clothing fashions,

or buying the latest technology gadget, or buying drugs.

The multiple choice answers are

quite varied. And unless you frame the

question properly to understand the real problem being solved (“What will make

me popular with my peers?”), you will not understand what is going on in the

mind of that person when they are making that choice. For

example, if you sell teen clothing, your biggest problem may be in convincing

that teen that your clothes will make them cooler with the in-crowd than the

latest smartphone.

That is why it is so important

for executives to look at sales as a multiple choice exercise for the

consumer. It helps orient executives

towards understanding:

1.

What problems the customer is trying to solve;

2.

What is the vast array of options that can solve that

problem; and

3.

How can I make my product become the best answer for

that multiple choice question.

And, as I found out as a child,

the best multiple choice answer usually has the most words. Or in this case,

the customer chooses the answer with the most attributes related to solving the

problem. And you won’t know which

attributes are relevant unless you understand which multiple choice question is

being asked.

The principle here is that if you want to increase sales, and do it profitably, you need to have a strategy which makes you the best option to a multiple choice question asked by a large segment of the population. There are only two ways to create that superiority—natural advantages or bribes.

Natural Advantages

A rational natural advantage

occurs when your product or service inherently has features making it meaningfully

superior to the alternatives in solving a customer’s problem. For example, if a consumer has a need for

durability in their bicycle, the manufacturer making the most durable bicycle

has a natural advantage over others trying to sell to that segment. It is the natural preferred choice because

the durability is a key part of the nature of that bicycle.

Natural advantages come in two

varieties: rational and emotional. A rational natural advantage would be like

that durability in the bicycle.

Durability is a rational excuse for preference. It can also be rationally shown that the

parts of a particular bicycle are stronger and longer lasting and more

reliable.

By contrast, an emotional

natural advantage occurs when your product or service provides makes consumers

feel better about themselves. Usually, that means that your offering provides a

superior feeling of self worth over the alternatives. For example, a status-seeking woman would

choose a Louis Vuitton handbag over others because that brand image provides a

superior sense of self worth to her. It’s really not about the durability of the

handbag. It’s the image and reputation

of Louis Vuitton which transfers to the owner of the brand, making her feel

better about herself.

Sometimes rational and emotional

advantages can become intertwined. For example, if you have a movie star known

for playing rugged, durable movie roles endorse the bicycle, some of the

emotional connection with the actor will transfer to the bicycle, reinforcing

the durability advantage.

WARNING: A natural advantage is

not the same as a strength. For example,

you may be strong in “quality,” but that is not an advantage if:

a)

There is insufficient demand for quality as a solution with

your market; or

b)

Others have a similar level of strength in quality

(your quality is not meaningfully superior in the mind of the customer).

Therefore, the goal is not to become

strong, but to become different and meaningful. In other words, a strength must also make

your solution superior to alternatives AND relevant in solving the particular

problem faced by the customer.

Any efforts in areas which do

not lead to difference or relevance are a waste of time. Therefore, you strategy should emphasize

trade-offs in the direction of difference and relevance.

Bribes

If you do not have a natural

advantage over the alternatives (or cannot create one), then the only way to

sell your product is to layer on incentives, like deep reductions in price or

gifts with purchase. I refer to these

added incentives as “bribes.” In other

words, if you cannot find a way to be “better” than the alternatives, then you

need to bribe people to choose you by being cheaper or more convenient than the

alternatives.

Bribery is the more difficult

path to sales, because it is costly and easily neutralized by

price-matching. Look at Apple. It has created strong natural

advantages. It has created rational

superiority in ease of use and features.

It has created emotional superiority with the “Cool Factor” and the

pride and self worth which comes from owning the Apple brand (big emotional

attachment). As a result, Apple can sell

millions upon millions of units at a premium price.

By contrast, the competition has

had difficulties creating natural advantages over Apple. As a result, the competitors have to sell

their products at a significantly lower price than Apple. In essence, the competitors are bribing

people to forgo the natural advantage of Apple because the price differential

is big enough to shift the value equation.

Of course, that price reduction

is a high price to pay to get sales. It

makes the competition far less profitable than Apple. Less profitability makes it harder to keep up

in innovation. And if the competition

ever starts getting closer to narrowing Apple’s advantage, all Apple has to do

is lower its price a little to get the advantage back.

Therefore, the best sales

strategy usually revolves around natural advantages rather than bribery.

Relevancy

So how do you create the natural

advantages which lead to a rise in profitable sales? Two actions must take

place. First, you need to fully

understand which problems people are trying to solve and all the factors going

into how they choose amongst the wide variety of alternatives. In other words, if you want to be the

superior option for the multiple choice question, you need to know what the

question is and how the person thinks about the solution (e.g., are my teenage

clothes creating superior acceptance over smartphones with the peer

group?). Only after taking these steps

will you know which strengths are worth pursuing.

Second, the only way to

typically become superior in these strengths is to focus on them more than

anyone else. Given limited time, money

and manpower, gaining superiority in one area means forgoing superiority in

other areas. It is a matter of

trade-offs—do less in a non-relevant area in order to do more in a relevant

area.

The first step tells you what is

relevant and the second step makes you relevant.

SUMMARY

To the customer, purchase decisions are the result of answering a multiple choice question: Which alternative best solves my problem or makes me feel better about myself? If you want the customer to answer that question by purchasing your offering, then you need to provide superiority on the factors most relevant to the problem being considered. That is best accomplished by determining the natural attributes which contribute to relevancy and then making the proper trade-offs needed to achieve superiority on those attributes. Otherwise, you are stuck with the weaker option of bribery.

Relevant superiority in natural attributes does not happen by chance. It requires forethought and a focused approach to trade-offs. That only comes by having a strategy. So if you want strong, profitable sales, start with a great strategy.